Despite sanctions, Iranian exporters continue to trade smarter in 2025, exploring new export alternatives, regional rout...

Iran-Brazil Exports: Growth, Products & B2B Trade

Iran’s Exports to Brazil: Opportunities and Challenges

Brazil, as the largest economy in South America and a member of BRICS, is considered a key market for the development of Iran’s non-oil exports. Over recent years, trade relations between Iran and Brazil have continuously grown, particularly in the fields of agricultural products, petrochemicals, and the food industry.

Iran exports various products to Brazil including bitumen, polymers, minerals, dried fruits (pistachios, raisins, dates), handmade carpets, and pharmaceutical products. In return, Brazil is one of Iran’s main suppliers of corn, soybean meal, raw sugar, and meat.

Given Brazil’s large population, steady economic growth, and diverse market needs, Iran’s exports to this country can play a significant role in expanding foreign trade. Additionally, the existence of shipping lines, the possibility of barter trade, and joint membership in international organizations all provide a foundation for expanding bilateral economic relations.

However, exporting to Brazil is not without challenges. These include geographical distance, differences in customs regulations, compliance with specific quality standards, and banking restrictions. To succeed in this market, Iranian companies need to be familiar with sanitary regulations, professional packaging, and targeted marketing.

Overall, Brazil represents a strategic market for high-quality Iranian products, especially if supported by appropriate trade policies and diplomatic backing.

Iran-Brazil Trade Overview (2021–2023)

In the solar year ending March 2022, Iran’s exports to Brazil were about $70 million, while total trade volume reached $5 billion (mostly imports from Brazil).

In the following year (1401–1402), Iran’s exports almost doubled to $134 million, and the overall trade value grew to over $6.5 billion.

Developments in 2024–2025

In just the first five months of the current Iranian fiscal year (March to August 2024), Iran’s non-oil exports to Brazil exceeded $163 million—nearly 2.5 times the total exports of the previous year (~$63 million).

According to official government data, the total trade volume between Iran and Brazil is estimated at around $8 billion, while Iran’s share in exports remains under $2 billion.

Key Iranian Export Products to Brazil

1. Urea Fertilizer

The most valuable Iranian export to Brazil in recent years. Widely used in Brazilian agriculture for plant nutrition and soil productivity.

2. Bitumen (Asphalt)

A petroleum derivative used in road construction and infrastructure projects. Exported to multiple countries including Brazil.

3. Petrochemicals and Polymers

Includes polyethylene, polypropylene, and other derivatives used in packaging, automotive, and industrial manufacturing.

4. Dates

Especially premium varieties like Mazafati. Consumed by Brazil’s Muslim population and health-conscious consumers.

5. Pistachios and Dried Fruits

Although volumes are lower than exports to Europe, the Brazilian market is growing. Used in food processing and retail.

6. Handmade Persian Carpets

A cultural and artistic product favored by Brazil’s affluent class. Limited volume, but high added value.

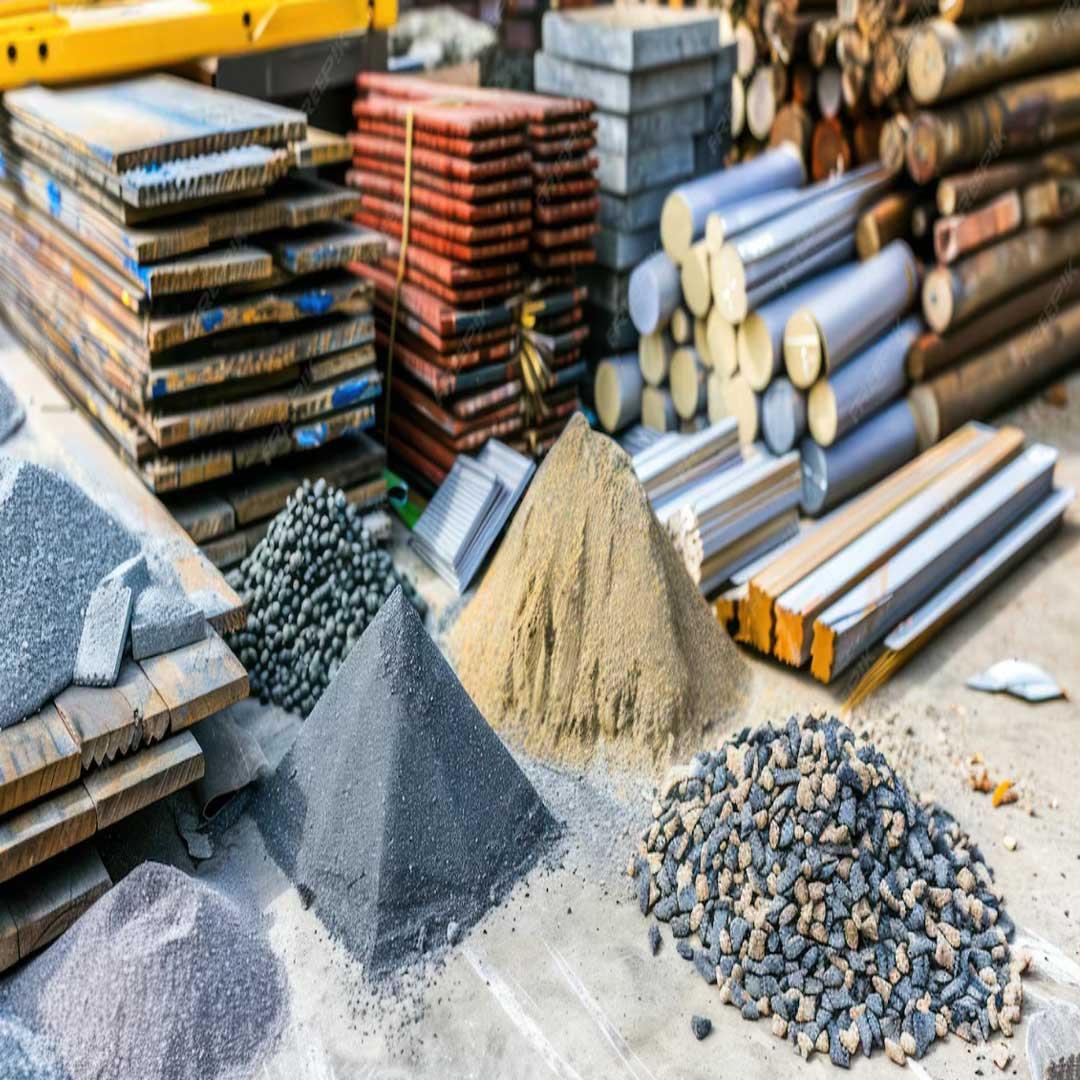

7. Minerals and Building Stones

Includes iron ore, marble, and decorative stones for construction and interior design in Brazil.

8. Specialty Chemicals and Pharmaceuticals

Includes pharmaceutical raw materials and industrial additives. Requires Brazil’s health certifications.

Abrisham Road: A Pioneer in B2B Exporting to Brazil

Abrisham Road is the first specialized B2B export platform connecting Iranian manufacturers with bulk buyers in Brazil. Through digital infrastructure, global networking, and local presence, it facilitates product showcasing, negotiations, and fulfillment.

With a focus on strategic exports such as urea fertilizer, bitumen, dates, dried fruits, polymers, and handmade carpets, Abrisham Road has established itself as a key channel for non-oil trade with Brazil.

Its services include:

- Access to verified Iranian suppliers

- Bulk order placement by Brazilian importers

- Export consultation, translation, packaging, and logistics

- Compliance with Brazilian quality and customs standards

By minimizing the gap between producer and importer, Abrisham Road has made the export process more professional, transparent, and competitive.

Conclusion: Strengthening Iran-Brazil Trade Through Strategic Export Channels

Brazil, as South America’s largest economy and a BRICS member, is a strategic destination for Iran’s non-oil exports. Trade has grown significantly in agriculture, petrochemicals, and food sectors. Key exports include urea, bitumen, polymers, dates, dried fruits, carpets, minerals, and pharmaceuticals.

From 2021 to 2024, Iran’s exports to Brazil have increased considerably, with non-oil exports surpassing $163 million in just five months of 2024. Meanwhile, total trade has reached nearly $8 billion, largely consisting of Iranian imports from Brazil.

Despite vast opportunities, exporters must navigate challenges such as long distances, regulatory differences, customs requirements, and financial limitations. Success depends on targeted marketing, quality packaging, and compliance with Brazil’s standards.

In this context, Abrisham Road has played a critical role in B2B trade development, offering end-to-end services to connect Iranian producers with Brazilian buyers.

With Brazil’s growing demand and platforms like Abrisham Road leading the way, Iran’s export potential to Brazil can become a sustainable engine for foreign trade growth.